Operations across 8 STATES and offshore GoM

Cactus' geographic footprint is rapidly expanding.

Cactus has non-operated working interests in over 100 wells across 8 states and the Outer Continental Shelf (OCS) of the Gulf of Mexico. We are active across most major US onshore plays, from the Permian Basin to the Bakken.

The Cactus asset base has been deliberately constructed to withstand substantial price shocks, with operating breakevens for most our assets sitting well below $35/bbl.

Cactus invests primarily in legacy conventional onshore wells that have been successfully producing for many years. Some of these wells produce < 10 bbls/d and are often overlooked by larger market participants.

We target wells with sub-10% annualized declines. This profile enables our portfolio to benefit from significant upside in the event of a medium-term price shock. We believe this optionality is fundamentally mispriced by the market.

We are actively consolidating a diversified portfolio of high margin, low decline assets with low operational risk. Our ambition is to become a leading independent with best-in-class technological capabilities and cost control.

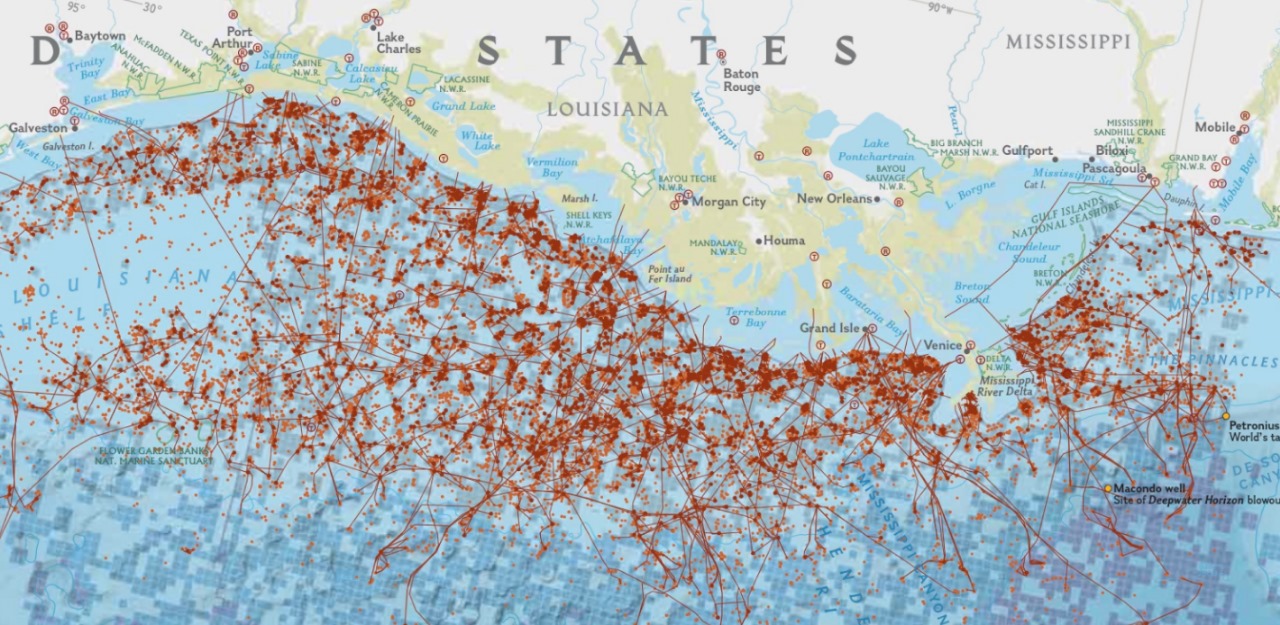

Cactus in the Deepwater GOM

Strategic acquisition in MS Canyon

Attractive, ultra-low breakeven production.

The Department of the Interior’s Bureau of Ocean Energy Management (BOEM) recognizes Old Cactus Holdings, LLC, as qualified to bid for and operate leases on the Outer Continental Shelf of the United States, including the Gulf of Mexico, the Atlantic, the Pacific and offshore Alaska.

Cactus first entered the Gulf of Mexico through the strategic acquisition of a non-operated interest in the Mississippi Canyon in November 2022. With an estimated operating breakeven of <$12/boe, low declines and no near-term decommissioning liabilities, the asset was considered a strong strategic fit for our portfolio despite its departure from our core onshore portfolio.

Production from the field is comingled with crude streams from various offshore fields in the Mississippi Canyon and transported via the Mars Oil Pipeline to Chevron’s Fourchon terminal and LOOP’s Clovelly terminal.

Based on BP’s latest assay, Mars Blend has an API gravity of 29.4 degrees and sulfur content of 1.87%, leading to its frequent categorization as a “medium sour” grade. Argus estimates that the total Mars Blend stream is around ~370,000 - 400,000 b/d.